A loan proposal is a structured document that provides potential lenders with a comprehensive overview of your loan request. It typically includes details about the loan amount, the purpose of the loan, your financial background (or your business’s financials), and your proposed repayment plan. It’s not the same as a business plan, although a business plan can be a valuable supporting document, especially for business loan proposals. A loan proposal is more focused and concise, specifically addressing the lender’s primary concern: how will they get their money back?

The Importance of a Well-Crafted Proposal

Why can’t you just walk into a bank and ask for a loan? Well, you could try, but you’d likely be met with a lot of raised eyebrows and a quick exit. A well-crafted loan proposal is crucial for several reasons:

- Professionalism: It shows that you’re serious about your request and have taken the time to prepare a professional document. This instantly boosts your credibility in the eyes of the lender.

- Clarity: It clearly articulates your needs and how you plan to use the funds. This helps the lender understand your request and make an informed decision.

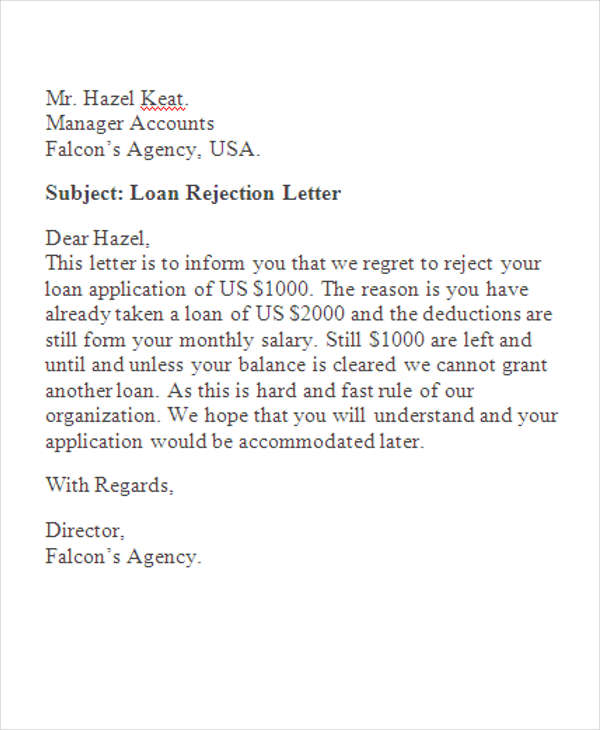

- Risk Assessment: It provides the lender with the information they need to assess the risk of lending you money. A strong proposal demonstrates your financial stability and your ability to repay the loan, reducing the lender’s perceived risk.

- Negotiation Power: A well-researched and detailed proposal can give you more leverage when negotiating loan terms, such as interest rates and repayment schedules.

Exploring Different Loan Proposal Formats

Loan proposals come in various shapes and sizes, depending on the type of loan you’re seeking:

- Business Loan Proposals: These proposals are geared towards businesses seeking funding for various purposes, such as expansion, equipment purchases, or working capital. They typically include detailed financial projections, market analysis, and information about the company’s management team.

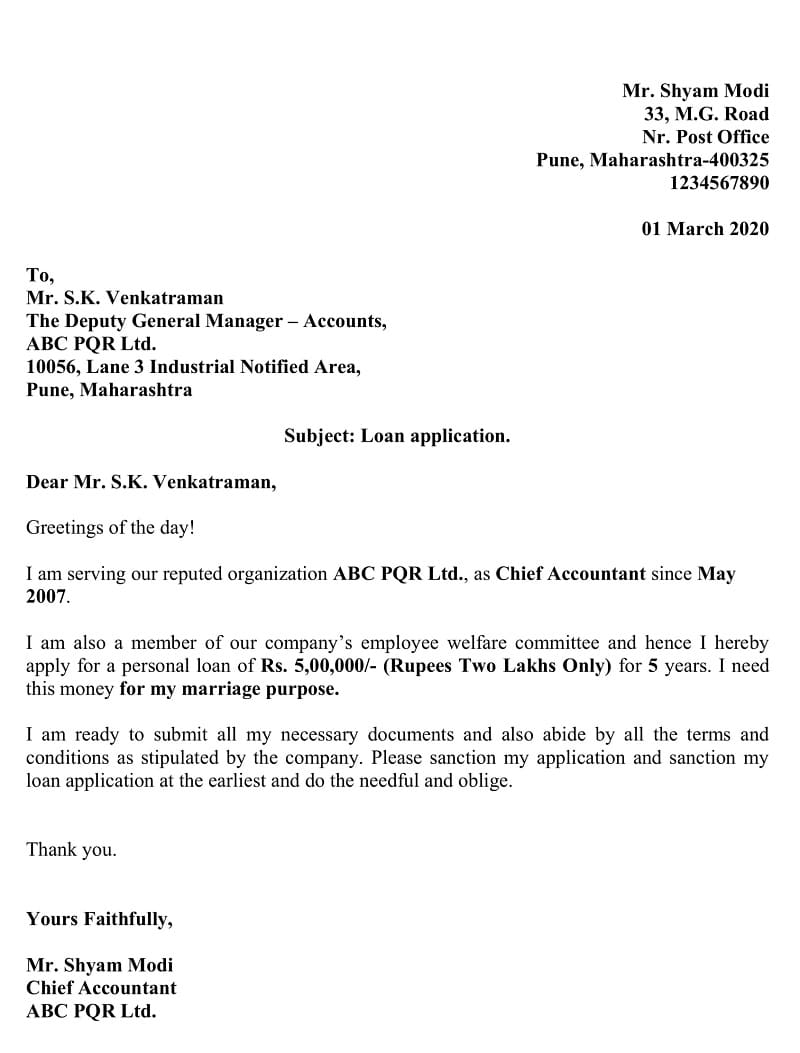

- Personal Loan Proposals: These proposals are for individuals seeking loans for personal reasons, such as education, home improvements, or debt consolidation. They generally focus on the individual’s income, credit history, and personal financial situation.

- Non-Profit Loan Proposals: Non-profit organizations may need loans for specific projects or operational expenses. Their proposals emphasize the project’s impact, the organization’s sustainability, and how the loan will help them achieve their mission.

Identifying Your Audience

Knowing your audience is paramount when writing a loan proposal. Are you pitching to a bank, a credit union, an angel investor, or a venture capitalist? Each lender has different priorities and risk tolerances. Tailoring your proposal to the specific lender you’re targeting will significantly increase your chances of success. For example, a bank might be more interested in your steady income and collateral, while a venture capitalist might be more interested in your innovative idea and growth potential. Do your homework and understand what each lender is looking for. It’s like dating – you wouldn’t wear the same outfit to a fancy dinner as you would to a rock concert, right? The same principle applies to loan proposals.

Structuring Your Loan Proposal (The Essential Elements of a Winning Loan Proposal)

Now that we’ve covered the basics, let’s dive into the anatomy of a winning loan proposal. Think of your proposal as a story you’re telling the lender, a narrative that convinces them of your worthiness. Every good story has a structure, and so does a compelling loan proposal. Here are the essential elements you need to include:

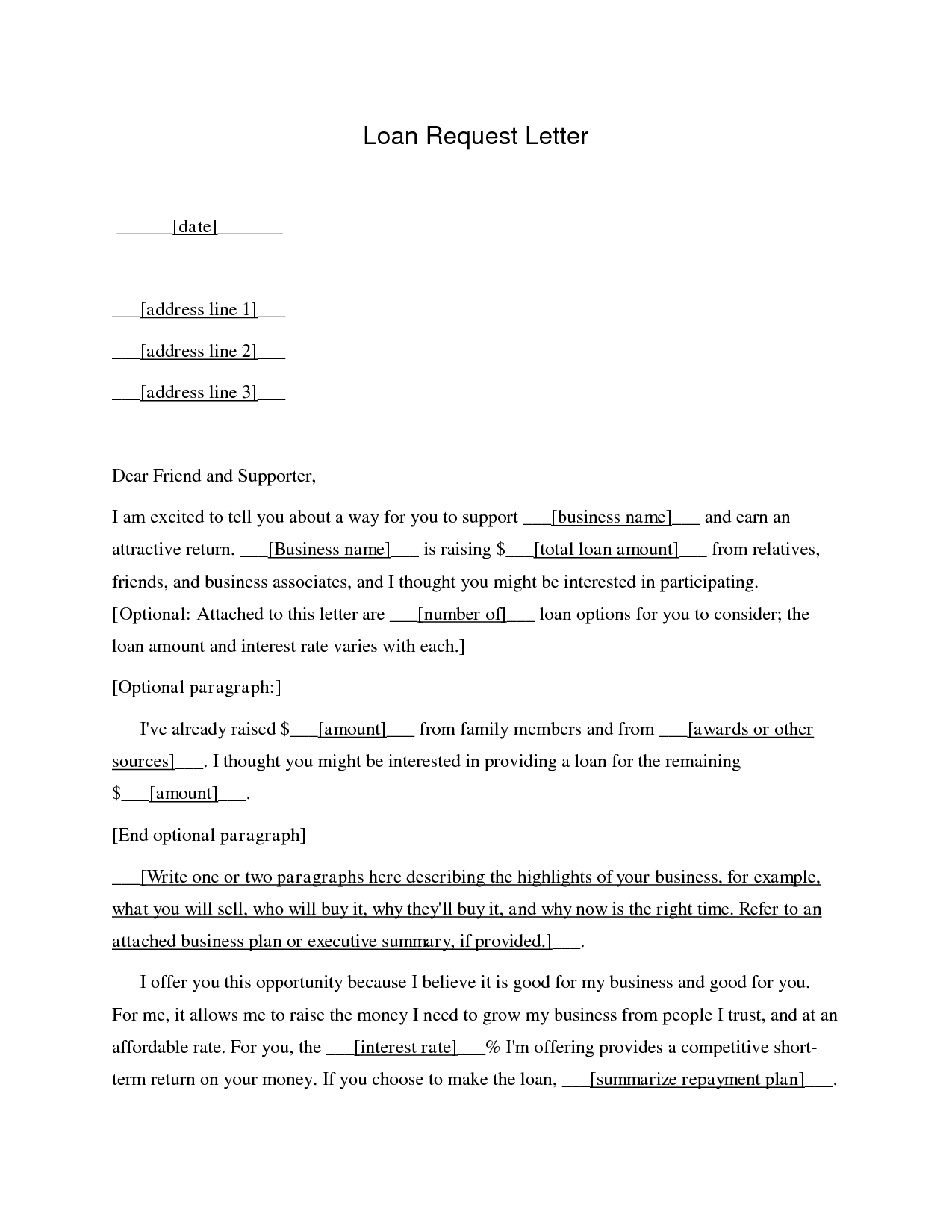

Making a Strong First Impression: The Cover Letter/Executive Summary

The cover letter, or executive summary, is your first chance to grab the lender’s attention. It’s a brief overview of your loan request, highlighting the key points of your proposal. Think of it as the movie trailer that entices viewers to watch the whole film. Keep it concise (no more than one or two pages) and focus on the following:

- Loan Amount: Clearly state the amount of money you’re requesting.

- Purpose of the Loan: Briefly explain how you intend to use the funds. Be specific! “Working capital” is vague; “purchasing new inventory to fulfill a large order from Company X” is much better.

- Key Highlights: Briefly mention your company’s (or your personal) key achievements or strengths that make you a good investment.

- Contact Information: Provide your complete contact details.

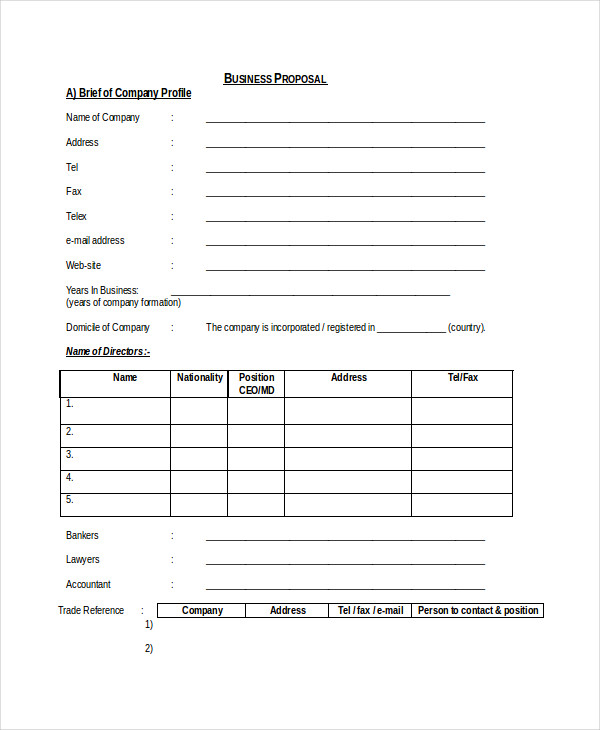

Showcasing Your Credibility: Company/Personal Background

This section is where you introduce yourself or your business to the lender. It’s your opportunity to build trust and demonstrate your expertise.

- For Businesses: Include your company’s history, mission statement, team members (and their experience), market analysis (who are your customers, what’s your competitive advantage?), and legal structure.

- For Individuals: Share your personal history, education, employment history, financial status (income, assets, liabilities), and credit score. Don’t be shy about highlighting your accomplishments!

Clearly Stating Your Needs: Loan Request Details

This is the heart of your proposal. Be crystal clear about what you’re asking for:

- Specific Loan Amount: State the exact amount of money you need. Don’t round up!

- Purpose of the Loan: Provide a detailed explanation of how the funds will be used. The more specific you are, the better. For example, if you’re buying equipment, specify the type of equipment, the vendor, and the cost.

- Proposed Loan Terms: Suggest your preferred loan terms, including the interest rate, repayment schedule (monthly, quarterly, etc.), and loan duration. Research prevailing interest rates for similar loans to ensure your proposal is realistic.

Demonstrating Financial Viability: Financial Projections (for Business Loans)

If you’re writing a business loan proposal, this section is crucial. Lenders want to see that your business is financially sound and has the potential to generate enough revenue to repay the loan. Include:

- Projected Income Statements: Show your projected revenue and expenses for the next few years.

- Balance Sheets: Provide a snapshot of your company’s assets, liabilities, and equity.

- Cash Flow Statements: Demonstrate your ability to generate cash and meet your financial obligations.

- Key Financial Ratios: Calculate and present key financial ratios, such as profitability ratios, liquidity ratios, and debt ratios.

- Explanation of Financial Assumptions: Clearly explain the assumptions you’ve made in your financial projections.

Assuring Lenders of Repayment Ability: Repayment Plan

This section is all about convincing the lender that you can and will repay the loan. Be specific and realistic:

- Detailed Explanation: Describe how you plan to repay the loan. Will it come from business revenue, personal income, or a combination of both?

- Sources of Income/Revenue: Identify the specific sources of income or revenue that will be used for repayment.

- Contingency Plans: What happens if things don’t go as planned? Demonstrate that you’ve thought about potential risks and have contingency plans in place.

Securing the Loan: Collateral (if applicable)

Some loans require collateral, which is an asset that the lender can seize if you default on the loan. If you’re offering collateral, be sure to:

- Describe the Collateral: Clearly describe the asset you’re offering as collateral (e.g., real estate, equipment, inventory).

- Valuation of the Collateral: Provide an independent appraisal of the collateral’s value.

Providing Additional Evidence: Appendix (Supporting Documents)

The appendix is where you include any supporting documents that further strengthen your proposal. This might include:

- Financial Statements: Tax returns, bank statements, audited financial statements (for businesses).

- Credit Reports: Personal credit reports (for personal loans).

- Business Plans: If you have a business plan, include it here.

- Letters of Recommendation: Letters from clients, suppliers, or other business associates.

Remember, each section plays a vital role in building your case. A well-structured proposal tells a compelling story and increases your chances of securing the funding you need.

Writing a Compelling Loan Proposal (Crafting a Persuasive Narrative)

Okay, you’ve got the structure down. Now, let’s talk about how to actually write your loan proposal in a way that resonates with lenders. It’s not just about presenting facts and figures; it’s about crafting a persuasive narrative that captures their attention and convinces them that you’re a worthy investment. Think of it as telling a story, but with numbers and data to back it up.

Communicating Effectively: Clarity and Conciseness

Nobody wants to wade through pages of jargon and convoluted sentences. Your loan proposal should be clear, concise, and easy to read. Use simple language, avoid technical terms unless absolutely necessary (and then explain them!), and get straight to the point. Remember, lenders are busy people. They want to quickly understand your request and assess your ability to repay the loan. Think of it like explaining your idea to a five-year-old – simple, clear, and engaging.

Maintaining a Professional Demeanor: Professional Tone

This should be a no-brainer, but it’s worth emphasizing. Maintain a professional and respectful tone throughout your proposal. Avoid slang, informal language, or anything that could be perceived as unprofessional. Proofread your proposal carefully for grammar and spelling errors. A polished and professional document demonstrates your attention to detail and your seriousness about the loan request. It’s like going to a job interview – you want to make a good impression.

Highlighting the Benefits for the Lender: Strong Value Proposition

What’s in it for the lender? That’s the question they’re asking themselves. You need to clearly articulate the benefits of lending you money. This could be in the form of interest earned, potential return on investment (ROI), or the positive impact your project will have on the community. Focus on what the lender gains by partnering with you. It’s not about what you need; it’s about what they get.

Backing Up Your Claims: Data and Evidence

Don’t just make claims; back them up with data and evidence. If you’re projecting a certain revenue growth, explain how you arrived at that figure. Provide market research, financial statements, or any other relevant data that supports your projections. Credible data builds trust and demonstrates that you’ve done your homework. It’s like a scientific experiment – you need evidence to support your hypothesis.

Proactively Mitigating Risks: Addressing Potential Concerns

Lenders are risk-averse. They want to know that you’ve considered potential challenges and have plans in place to address them. Proactively address any potential concerns a lender might have. For example, if your business is in a competitive market, explain how you plan to differentiate yourself. If you’re relying on a single client for a significant portion of your revenue, explain what you’ll do if you lose that client. Addressing these concerns upfront shows that you’re prepared and have thought things through. It’s like having a backup plan – it shows you’re resourceful and resilient.

Loan Proposal Template and Examples (Practical Resources)

Now that you’re armed with the knowledge of how to write a loan proposal, let’s get practical! Sometimes, seeing a real-world example can be incredibly helpful. Think of it as looking at a chef’s finished dish before attempting the recipe yourself. While I can’t provide specific financial information due to privacy, I can guide you to some excellent resources and offer a general framework. Remember, these are templates and examples; you’ll need to customize them to fit your specific situation.

- Online Resources: Many websites offer free loan proposal templates. A simple search for “loan proposal template” will yield a plethora of results. Look for templates that are specifically tailored to the type of loan you’re seeking (business, personal, etc.). Some reputable sites to check include those from financial institutions or business resource centers.

- Small Business Administration (SBA): The SBA website is a goldmine of information for small business owners, including resources on loan proposals. They often have templates and guides available.

- SCORE: SCORE is a non-profit organization that provides free mentoring and resources to small businesses. They can also be a valuable source of information on loan proposals.

- Financial Institutions: Some banks and credit unions may offer their own loan proposal templates or guidelines. Check with your preferred lender to see if they have any specific requirements.

General Loan Proposal Template Outline:

-

Cover Letter/Executive Summary: (1-2 pages max)

- Loan amount requested

- Purpose of the loan (briefly)

- Key highlights (your strengths)

- Contact information

-

Company/Personal Background: (1-3 pages)

- Business: History, mission, team, market analysis, legal structure.

- Individual: Personal history, education, employment, financial status, credit score.

-

Loan Request Details: (1-2 pages)

- Specific loan amount

- Detailed purpose of the loan

- Proposed loan terms (interest rate, repayment schedule, duration)

-

Financial Projections (Business Loans Only): (2-5 pages)

- Projected income statements (3-5 years)

- Balance sheets (3-5 years)

- Cash flow statements (3-5 years)

- Key financial ratios

- Explanation of financial assumptions

-

Repayment Plan: (1-2 pages)

- Detailed explanation of how the loan will be repaid

- Sources of income/revenue

- Contingency plans

-

Collateral (If Applicable): (1-2 pages)

- Description of collateral

- Valuation of collateral

-

Appendix (Supporting Documents):

- Financial statements (tax returns, bank statements)

- Credit reports (personal loans)

- Business plan (if available)

- Letters of recommendation

Example Snippet (Company Background – Business Loan):

“Established in 2015, [Company Name] is a leading provider of innovative software solutions for the healthcare industry. Our mission is to streamline healthcare processes and improve patient outcomes through cutting-edge technology. Our team comprises experienced software developers, healthcare professionals, and business strategists with a proven track record of success. We have a strong market presence in the [Target Market] and have achieved consistent revenue growth of 20% year-over-year for the past three years. Our competitive advantage lies in our proprietary [Technology/Product] which offers [Key Benefits] to our clients.”

Remember, this is just a snippet. You’ll need to flesh out each section with specific details about your business or personal situation. Don’t just copy and paste; make it your own! Use these templates and examples as a starting point, but always tailor your loan proposal to the specific lender you’re targeting. It’s like getting a suit tailored – it might fit off the rack, but it looks much better when it’s custom-made.

Tips for Success (Increasing Your Chances of Approval)

Writing a stellar loan proposal is just the first step. Think of it as putting your best foot forward, but there’s more to it than just having a nice pair of shoes. Here are some additional tips to maximize your chances of loan approval:

-

Research Your Lender Thoroughly: Don’t just walk into the nearest bank and submit a proposal. Do your research! Understand the lender’s lending criteria, their preferred loan types, and their risk tolerance. Tailoring your proposal to the specific lender will significantly increase your chances of success. It’s like choosing the right fishing bait – some fish prefer worms, others prefer lures.

-

Tailor Your Proposal to the Specific Lender: Generic loan proposals rarely succeed. Lenders want to see that you’ve taken the time to understand their needs and have crafted a proposal that addresses those needs. Mention specific projects or initiatives they’ve funded in the past. Show them that you’ve done your homework. It’s like writing a cover letter for a job application – you wouldn’t send the same generic letter to every company.

-

Network and Build Relationships with Potential Lenders: Networking is key in the world of finance. Attend industry events, connect with lenders on LinkedIn, and build relationships with people who can introduce you to potential lenders. A personal introduction can go a long way in getting your proposal noticed. It’s like getting a referral for a job – it gives you a leg up on the competition.

-

Follow Up After Submitting Your Proposal: Don’t just send your proposal and then sit back and wait. Follow up with the lender to confirm that they received it and to inquire about the next steps in the process. A polite follow-up demonstrates your professionalism and your eagerness to secure the loan. It’s like sending a thank-you note after a job interview – it shows you’re interested and appreciative.

-

Be Prepared to Answer Questions: Lenders will likely have questions about your proposal. Be prepared to answer them clearly and confidently. Anticipate potential questions and have your answers ready. This demonstrates your preparedness and your understanding of your business or personal finances. It’s like studying for an exam – you want to be prepared for any question they throw at you.

-

Highlight Your Strengths and Minimize Your Weaknesses: Focus on the positive aspects of your proposal. Highlight your strengths, your achievements, and your potential for growth. Be honest about any weaknesses, but also emphasize how you plan to mitigate those weaknesses. It’s like a job interview – you want to showcase your best qualities while also acknowledging any areas where you can improve.

-

Seek Professional Advice: If you’re unsure about any aspect of the loan proposal process, seek professional advice from a financial advisor, a business consultant, or an accountant. They can provide valuable insights and help you craft a stronger proposal. It’s like hiring a coach – they can help you improve your skills and reach your goals.

Common Mistakes to Avoid (Steering Clear of Pitfalls)

Just as there are things you should do, there are also things you should definitely avoid when writing a loan proposal. These common mistakes can sink your chances of approval faster than you can say “denied.”

-

Incomplete or Inaccurate Information: Double-check all the information in your proposal for accuracy and completeness. Any errors or omissions can damage your credibility and raise red flags for the lender. It’s like filing your taxes – you want to make sure everything is accurate to avoid an audit.

-

Unrealistic Financial Projections: Don’t inflate your financial projections to make your loan request seem more appealing. Lenders are savvy and will see through unrealistic assumptions. Be honest and realistic in your projections. It’s better to under-promise and over-deliver than the other way around.

-

Lack of a Clear Repayment Plan: A vague or unclear repayment plan is a major red flag for lenders. They want to know exactly how you plan to repay the loan. Provide a detailed and realistic repayment plan that demonstrates your ability to meet your financial obligations. It’s like promising to pay someone back – you need to have a clear plan for how you’re going to do it.

-

Poorly Written or Unprofessional Proposal: A poorly written or unprofessional proposal will make a bad impression on the lender. Proofread carefully for grammar and spelling errors. Use clear and concise language. Present your proposal in a professional format. It’s like going to a job interview in your pajamas – you wouldn’t do it!

-

Failure to Address Potential Concerns: As we discussed earlier, lenders are risk-averse. If you fail to address potential concerns in your proposal, the lender will likely assume that you haven’t thought about them. Proactively address potential concerns and demonstrate that you have mitigation plans in place. It’s like anticipating your opponent’s moves in a chess game – you want to be prepared for anything.

-

Submitting a Generic Proposal: Sending the same generic loan proposal to multiple lenders is a recipe for disaster. Each lender has different needs and priorities. Tailor your proposal to each specific lender to maximize your chances of success. It’s like trying to fit a square peg into a round hole – it’s not going to work.

Leave a Reply